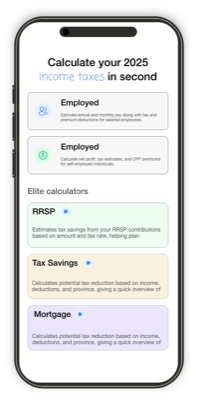

Free Canadian Income Tax Calculator 2025 & 2026 - Calculate Your Take-Home Pay

Calculate your 2025 or 2026 income taxes in seconds with our accurate progressive tax bracket calculator. Get detailed take-home pay, CPP, EI, and provincial deductions instantly.

Your Income Details

Select the tax year you want to calculate. Rates are automatically updated.

Deductible business expenses for self-employed income

Your Tax Summary

Total Income

$0

Total Tax

$0

After-Tax Income

$0

$0 / month

Average Tax Rate

0%

Marginal Tax Rate

0%

Tax Breakdown

Monthly Budget

50/30/20 RuleThis calculator provides estimates only. Consult a tax professional for personalized advice.

Other provinces and territories

Calculate your taxes for any Canadian province or territory

Selected and popular posts on the social right now

Explore our latest insights and financial guides