Calculate your 2025 income taxes in seconds.

Calculate your 2025 income taxes in seconds. Get detailed take-home pay, CPP, EI, and provincial deductions instantly.

T4 Payroll (Salary and Wages)

Your Details

Results

Annual Net Take-Home Pay

$0 / year

Monthly Take Home

$0 / month

Deduction Breakdown

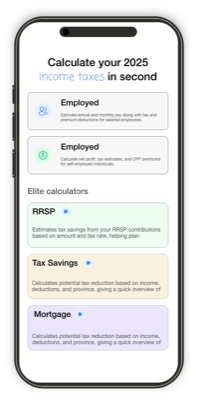

Take MTC with you anywhere.

Download our official Android app for instant tax calculations, offline access, and saving your scenarios. Planning your finances has never been easier.

Financial Calculators & Tools

RRSP Planner

Optimize your retirement savings and immediate tax deduction.

RESP Estimator

Calculate tax-free growth potential within contribution limits.

Mortgage Calculator

Determine how much house you can afford based on income.

Tax Savings Estimator

Estimate the impact of credits, deductions, and expenses.

Debt Payoff Planner

Plan repayment strategies and calculate interest savings.

Finance Blog

Stay updated with the latest personal finance tips.

Plan Your Canadian Income

Plan your Canadian income with confidence using our 2025 Canada Income Tax Calculator. Instantly estimate your take-home pay, federal and provincial taxes, and CPP and EI deductions across Canada.

Why Choose Our Calculators?

Accuracy Guaranteed

All calculations use the latest official CRA tax brackets and rates.

Lightning Fast

Instantly calculate complex scenarios without waiting for external processing.

Mobile Friendly

Use our tools easily on any device, from desktop to smartphone.

Frequently Asked Questions

This calculator provides a close estimate of your real after-tax income using the most recent 2025 federal and provincial tax brackets, CPP, and EI contribution limits. It’s ideal for pay or budget planning but does not include individual tax credits, RRSP deductions, or unique personal credits (like dependents or tuition amounts). For complete accuracy, compare results to your official pay stub or consult the Canada Revenue Agency (CRA).

All mandatory payroll premiums are built in — including Canada Pension Plan (CPP) and Employment Insurance (EI) contributions. The calculator automatically applies the current yearly maximums and rates for both, giving you a realistic snapshot of what’s withheld from your paycheque. These contributions fund retirement, disability, and unemployment benefits, and are updated annually to reflect new CRA thresholds.

Minor differences happen because real pay depends on province-specific credits, RRSPs, union dues, or benefits your employer deducts at source. The tool uses average provincial rates and non-refundable tax credits to simplify your estimate — the same method leading calculators like Wealthsimple or UFile use. That means your displayed net income and take-home pay are realistic, just not exact.

Yes! This tool is perfect for comparing job offers or salary changes across any Canadian province or territory. By instantly adjusting income, location, and deductions, you can see how much you’ll actually take home after taxes, CPP, and EI. It helps you make better financial decisions when negotiating a new role, budgeting for relocation, or estimating the effect of a raise.

It provides a realistic estimate of your refund or taxes payable based on your total annual income, federal and provincial tax brackets, and mandatory contributions. While it’s not a substitute for official filing software, the results closely mirror CRA calculations using basic personal credits and 2025 tax rates. This makes it ideal for early tax refund planning or checking if your withholding aligns with your true tax liability.